Facebook buys 9.99% stake in Reliance Jio for Rs 43,574 cr, largest FDI in India’s tech sector

Facebook will invest Rs 43,574 crore in Jio Platforms, a unit of Reliance IndustriesNSE 0.51 % Ltd (RIL), for a 9.99% stake, an allcash deal that will help the oil-toretail conglomerate reduce debt and strengthen the social media company’s presence in its largest market, especially for its WhatsApp unit.

RIL’s shares closed 10.3% higher at Rs 1,363.35 on the BSE Wednesday, having surged more than 12% in intraday trade. The transaction will value Jio Platforms at Rs 4.62 lakh crore. Jio Platforms is the parent of phone and data unit Reliance Jio Infocomm and various digital app platforms such as JioMart, Jio-Saavn and JioCinema. Facebook will get a seat on the board of Jio Platforms, along with that of an observer, Jio strategy head Anshuman Thakur said on a conference call with reporters.

ET had reported on April 17 that RIL and Facebook were exploring the possibility of creating a super-app like China’s WeChat by leveraging Jio’s reach and WhatsApp’s ubiquity.

Independent Entities

However, WhatsApp and Jio will remain independent entities with their own business models and compete where necessary, in line with the respective business models, and collaborate in other areas where they see synergies, Thakur said.

Jio Platforms, Reliance Retail and WhatsApp have also signed a commercial pact to cross-leverage ecommerce platform JioMart and WhatsApp, to grow both businesses, the two companies said in separate statements Wednesday. Reliance Retail is RIL’s retail unit.

“The companies will work closely to ensure that consumers are able to access the nearest kiranas who can provide products and services to their homes by transacting seamlessly with JioMart using WhatsApp,” RIL said in a statement.

Both companies added that they will work together on some major projects that will open up commerce opportunities for people across India, but didn’t elaborate further.

“Reliance Industries Limited, Jio Platforms Limited and Facebook, Inc. today announced the signing of binding agreements for an investment of Rs 43,574 crore by Facebook into Jio Platforms,” RIL said. “This investment by Facebook values Jio Platforms at Rs 4.62 lakh crore pre-money enterprise value ($65.95 billion, assuma conversion rate of Rs 70 to a US dollar).”

The transaction is subject to regulatory and other customary approvals, RIL said. Separately, Jio officials said the only approval needed for the deal was from the Competition Commission of India.

A government official said the deal could be closely scrutinised by the anti-trust watchdog given both companies have the private data of millions of Indians, which may give the combine undue advantage against rivals — be it other tech giants such as Google and Amazon or local startups.

Reliance Jio Infocomm, which will continue to remain a wholly owned unit of Jio Platforms, has about 388 million users or roughly half the total mobile Internet users in the country. Facebook counts India as its largest market with 328 million monthly users. WhatsApp has 400 million users in the country, also the most in the world.

Some experts said the tie-up may give rise to possible concerns around net neutrality, especially the possibility of preferential treatment by Jio to Facebook and WhatsApp. Jio though rejected both concerns.

The deal also comes at a time when some analysts are concerned that, with the collapse in oil prices, there is an increasing risk to RIL’s deal to sell a stake to Aramco for $75 billion. This deal was a key element of RIL’s stated aim to become a net debt free company by March 2021.

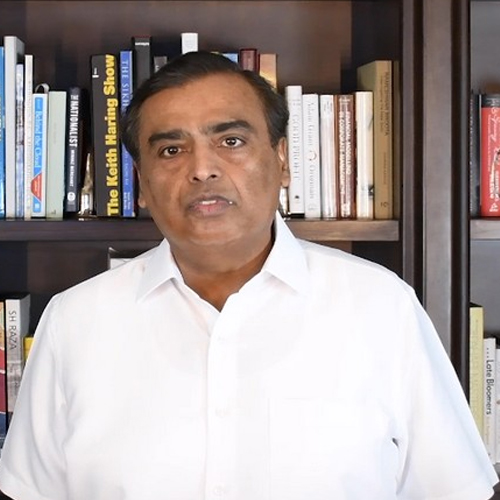

“At the core of our partnership is the commitment that Mark Zuckerberg, founder of Facebook, and I share for the all-round digital transformation of India and for serving all Indians… In the post-corona era, I am confident of India’s economic recovery and resurgence in the shortest period of time,” said Mukesh Ambani, chairman and MD of RIL, in the statement. “The partnership will surely make an important contribution to this transformation.”

RIL said this was the world’s largest investment for a minority stake by a technology company and the largest foreign direct investment (FDI) in the technology sector in India. The investment values Jio Platforms among the top five listed companies in India by market capitalisation, it said.

In a blog post, Facebook CEO Mark Zuckerberg said the deal underscores the company’s commitment to India.

“This is especially important right now, because small businesses are the core of every economy and they need our support,” Zuckerberg said. “India has more than 60 million small businesses and millions of people rely on them for jobs.”

He said Facebook will play a role in getting the global economy moving again.

“With communities around the world in lockdown, many of these entrepreneurs need digital tools they can rely on to find and communicate with customers and grow their businesses,” he said. “We’re looking forward to getting started”.

The main focus of the deal is to come up with digital-based solutions for 60 million micro, small and medium businesses, 120 million farmers, 30 million small merchants and millions of small and medium enterprises in the informal sector, the companies said.

“In the very near future, JioMart, Jio’s digital new commerce platform, and WhatsApp, will empower nearly 3 crore small Indian kirana shops to digitally transact with every customer in their neighbourhood,” Ambani said. “This means all of you can order and get faster delivery of day-to-day items, from nearby local shops.”

He added that the focus of the tie-up will be to create new ways for people and businesses to operate more effectively in the growing digital economy.

“For instance, by bringing together JioMart, Jio’s small business initiative, with the power of WhatsApp, we can enable people to connect with businesses, shop and ultimately purchase products in a seamless mobile experience,” Ambani said.

The deal will help cut RIL’s net debt, analysts said.

As of December 31, 2019, RIL’s net group debt stood at Rs 1.53 lakh crore, Credit Suisse said. With Facebook’s investment, the Indian group should be on course to be net debt free by March 2021, it said.

“The debt in the company (Jio Platforms) is around Rs 40,000 crore. (Of the deal funds) Rs 15,000 crore would be retained in the company and the balance would be used to redeem OCPS (optionally convertible preference shares) investments of RIL in this company (Jio Platforms),” Jio strategy head Thakur said. “And the net debt of Jio Platforms will also correspondingly come down because of Rs 15,000 crore cash which is retained in the company.”

Thakur also said that RIL’s plan to take Reliance Jio Infocomm public remains on the table.

With oil prices plunging, “the risk that the deal (RIL-Aramco) will not go (through) has increased although we now value downstream at $55 billion gross which is a 20% discount to Aramco valuation,” according to brokerage Bernstein.

Analysts said the Jio deal also allows Facebook to strengthen WhatsApp as a customer services/social commerce tool in India.